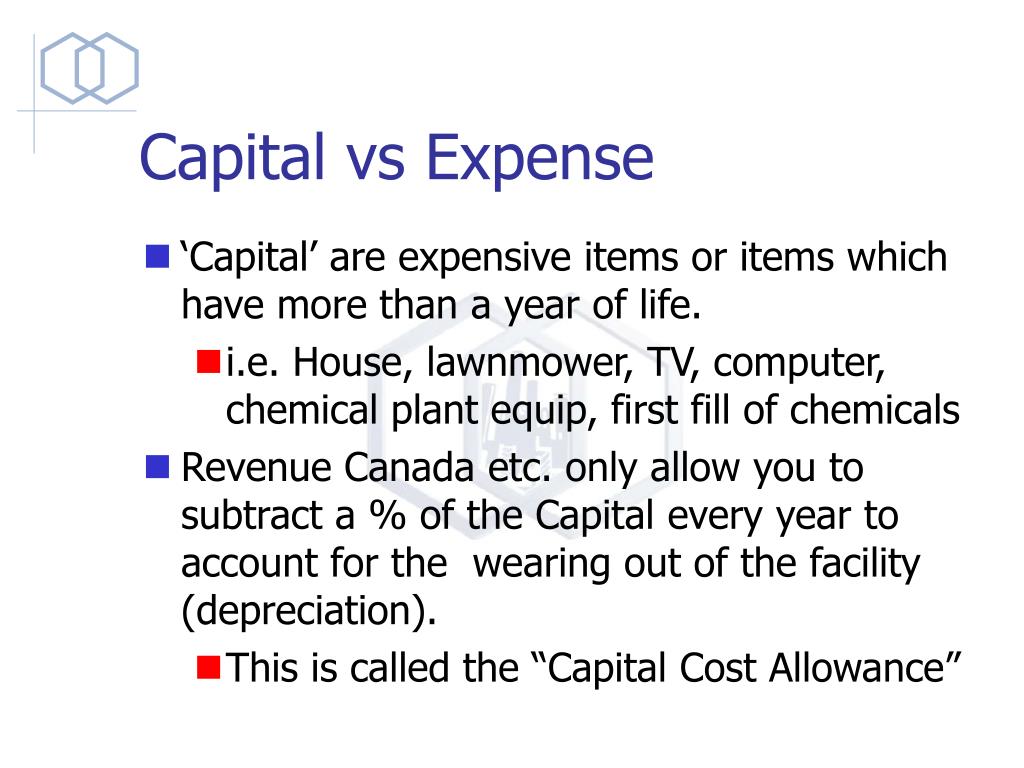

These expenditures have a substantial effect on both the short-term and long-term financial standing of companies. Naturally, the most capital-intensive industries (like oil exploration and production, telecommunication, manufacturing, and utility industries) have the highest levels of capital expenditures. You might use collateral or take on debt to make a capital expenditure. The type of industry in which a company operates largely determines the nature of its capital expenditures. Capital expenses, or CAPEX, are expenses that a business incurs that are expected to remain valuable beyond the current year. Put simply, capital expenditures are payments made for long-term fixed assets, while operational expenditures are made for day-to-day expenses. CapEx spending is important for companies to maintain existing. Capital expenditures are one-time purchases like vehicles, machinery or real estate that add value to your business. There are two types of expenditures: revenue and capital. Examples of capital expenditures made to increase or improve assets include the purchase of: new work equipment, machinery, land, plants, buildings, warehouses, furniture, fixtures, vehicles, hardware, software, and intangible assets such as patents and licenses. Capital expenses include the cost of fixed assets and the acquisition of intangible assets. Where expenses are purchases to increase revenue, expenditures are made to improve the long-term value of the company. Capitalization requires that a company spread the cost of a capitalized expenditure over the useful life of the asset.Ĭapitalized expenditures are made by companies in order to maintain their existing property and equipment, increase the scope of their operations, or create some other economic benefit.

Such expenses are recorded, or capitalized, on a company’s balance sheet as an investment, whereas ordinary expenses are expensed on a company’s income statement and deducted fully in the year the expense is incurred.

As opposed to an ordinary (or operating expense), which covers the day-to-day costs necessary to keep a business running, a capitalized expenditure is an expense that is made to 1) acquire an asset (whether tangible or intangible) that has a useful life longer than a year or 2) improve the useful life of an existing capital asset (like property, plants, buildings, technology and equipment).

0 kommentar(er)

0 kommentar(er)